FASANARA CAPITAL is a boutique alternative asset manager, offering access to a range of inventive multi-asset capacity-constrained niche products. Fasanara's unorthodox portfolio construction and unconventional investment strategy is a response to today’s transformational markets.

"In an effort to escape a dramatic negative yield environment globally, at a time when $15 trillion worth of bonds are trading at negative yields, Fasanara ventured into the brand new asset class of digital receivables"

In an effort to escape a dramatic negative yield environment globally, at a time when $15 trillion worth of bonds are trading at negative yields, Fasanara ventured into the brand new asset class of digital receivables.

Through new technologies and proprietary Fintech, Fasanara helps SMEs with working-capital financing, having assembled a platform infrastructure across 20 different countries so to be able to originate best corporate receivables across granular portfolios, using cutting-edge Machine Learning modelling and Artificial Intelligence analytics.

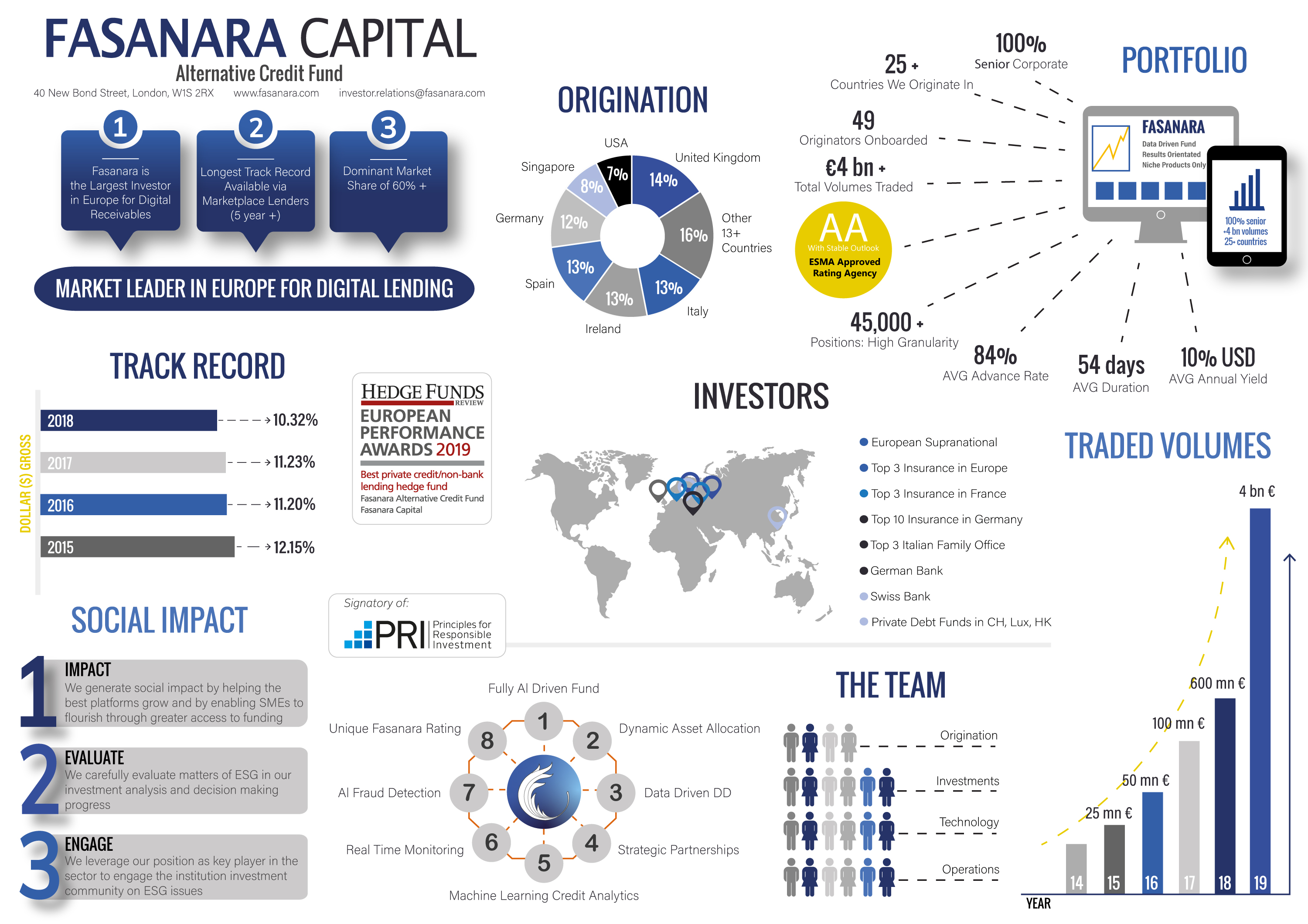

In this fascinating new market niche, Fasanara is today the largest investor in Europe, with the largest market share and the longest track record of 5 years, dating back to the early days of the new asset class of digital receivables in Europe.

Fasanara transacted on more than $2.5bn volumes over the past 5 years, and is expected to cross the $4bn mark early next year.

"Using technology and systems theory to help democratise financial services for SME in ways that are sustainable, equitable, transparent and empowered with data."

The portfolio of Fasanara was awarded a long-term public credit rating of AA with stable outlook, by an ESMA approved rating agency. The average duration across portfolios is ultra-short, at just 40-50 days. Credit positions are all senior, and built across widely diversified portfolios.

Despite such security package, the annualised yield of the portfolio is between 5% and 8% in EUR, or 7% to 10% in US Dollars, with a volatility of 1%, resulting in a robust sharpe ratio of 7 to 9.

Fasanara leverages on best-in-class Machine Learning Credit Analytics and Artificial Intelligence techniques, through both proprietary systems and powerful external partnerships, for rating assessments and AI-driven dynamic asset allocation.

We focus both on granular credit risk and systemic-network risk propagation, building up the theoretical foundations of the multi-layered credit behaviour prediction model employed by Fasanara: the Fasanara Credit Model (‘FCM’).

Fasanara provides for each one of its constituent loans a specific Fasanara Debtor Rating (‘FDR’), leveraging on the proprietary Fasanara Genesis Alpha Database (‘FGAD’) of Eur 2.5bn volumes and millions of loan data points.

Fasanara is a firm believer in open ecosystems and collaborative organisations, where we tie up with leading academic institutions and research groups to broaden our boundaries and establish superior understanding, better data and processing power.

"Our mission is to provide working-capital financing solutions to SMEs globally, using cutting-edge fintech, optimising and repurposing capital allocationm ensuring small companies can make quicker, seamless and sustainable funding decisions."